DAN COOPER GROUP

Industry real estate experts project a continued balanced market for the Greater Toronto Area (GTA) heading into the fall and winter.

In September, total inventory reached 18,912 active listings, the highest level seen since June 2019. This monthly surge of 3,415 listings represents a 22% increase, the most substantial percentage gain since April 2022.

The real estate landscape in the GTA has seen a complex interplay of factors as buyers navigated the challenging environment of rising interest rates over the past 18 months. Buyers and homeowners are now faced with the question of how long these elevated rates will persist. The rise in long-term bond yields, indicating the belief that interest rates will remain at their current levels, has a direct impact on borrowing costs, including mortgages up for renewal. The Canadian real estate market is now adapting to a “higher- for-longer” interest rate environment, where historically low rates may no longer be the norm.

“The short and medium-term outlooks for the GTA housing market are very different. In the short term, the consensus view is that borrowing costs will remain elevated until mid-2024, after which they will start to trend lower. This suggests that we should start to see a market uptick in demand for ownership housing in the second half of next year, as lower rates and record population growth spur an increase in buyers,” said TRREB President Paul Baron.

While property prices continue to rebound and the market remains resilient, the surge in available properties and the uncertainty surrounding interest rates have created a cautious environment for both prospective buyers and sellers. The market’s response to central banks’ announcements and the potential for future interest rate changes underscores its acute sensitivity to broader economic factors. Despite a temporary dip in sales, the month of September witnessed positive price trends across various property segments, further illustrating the demand for housing even in evolving economic conditions.

The average selling price was $1,082,496 as compared to $1,118,374 the previous month. The average price is above last year’s average of $1,079,048. The average number of listing days on the market was 20 as compared to 17 from the previous month. Total active listings were up to 16.5% year-over-year, and new listings were up 16.2% year-over-year, from 10,578 in August 2022 to 12,296 in August 2023.

No one has a crystal ball, so no one can predict further rate hikes, and the market needs to wait and see the full impact the previous rate increases have had on the economy.

INSIGHTS

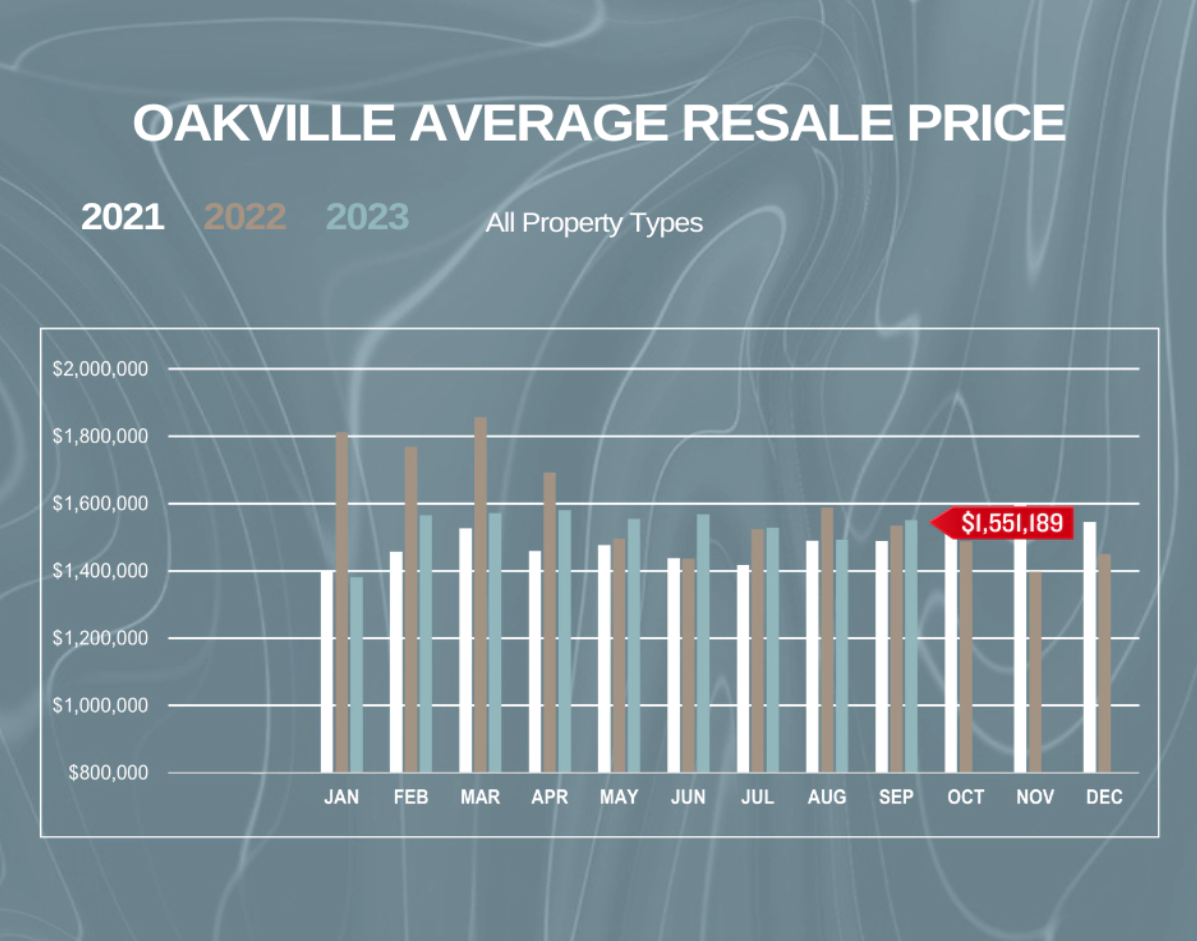

Oakville MARKET INSIGHTS

Market Insights

All property types

SEPTEMBER 2022

SEPTEMBER 2023

191

Homes Sold

-4.71%

183

Homes Sold

$1,534,810

Avg. Resale Price

+1.07%

$1,551,189

Avg. Resale Price

sEPTEMBER 2023 Stats

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

101

7

32

13

27

$1,989,900

$1,129,857

$1,203,563

$986,685

$750,910

Oakville Average Resale Price

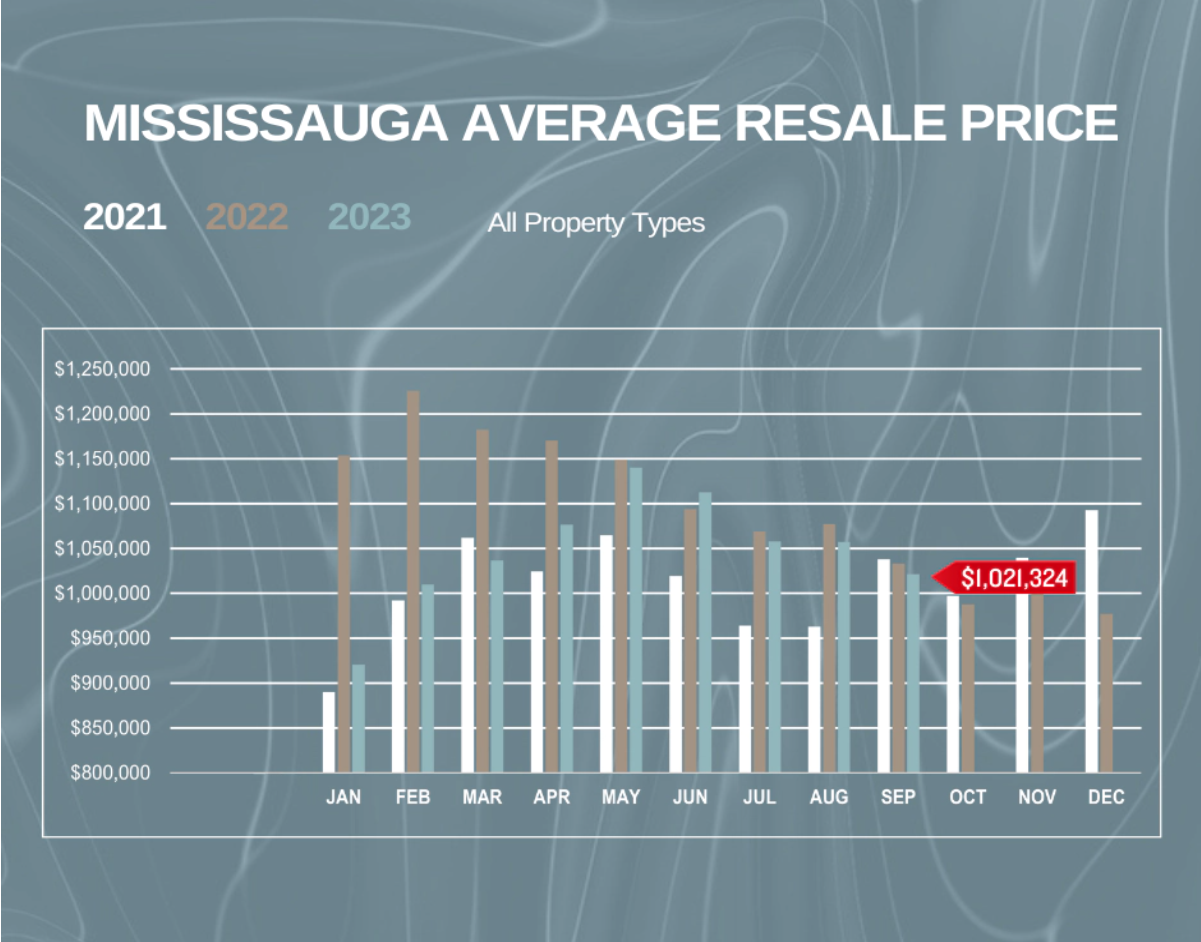

MISSISSAUGA MARKET INSIGHTS

Market Insights

All property types

SEPTEMBER 2022

SEPTEMBER 2023

466

Homes Sold

-17.17%

386

Homes Sold

$1,032,889

Avg. Resale Price

-1.12%

$1,021,324

Avg. Resale Price

SEPTEMBER 2023 STATS

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

140

36

13

72

122

$1,439,735

$1,084,793

$1,028,231

$796,440

$652,653

MISSISSAUGA Average Resale Price

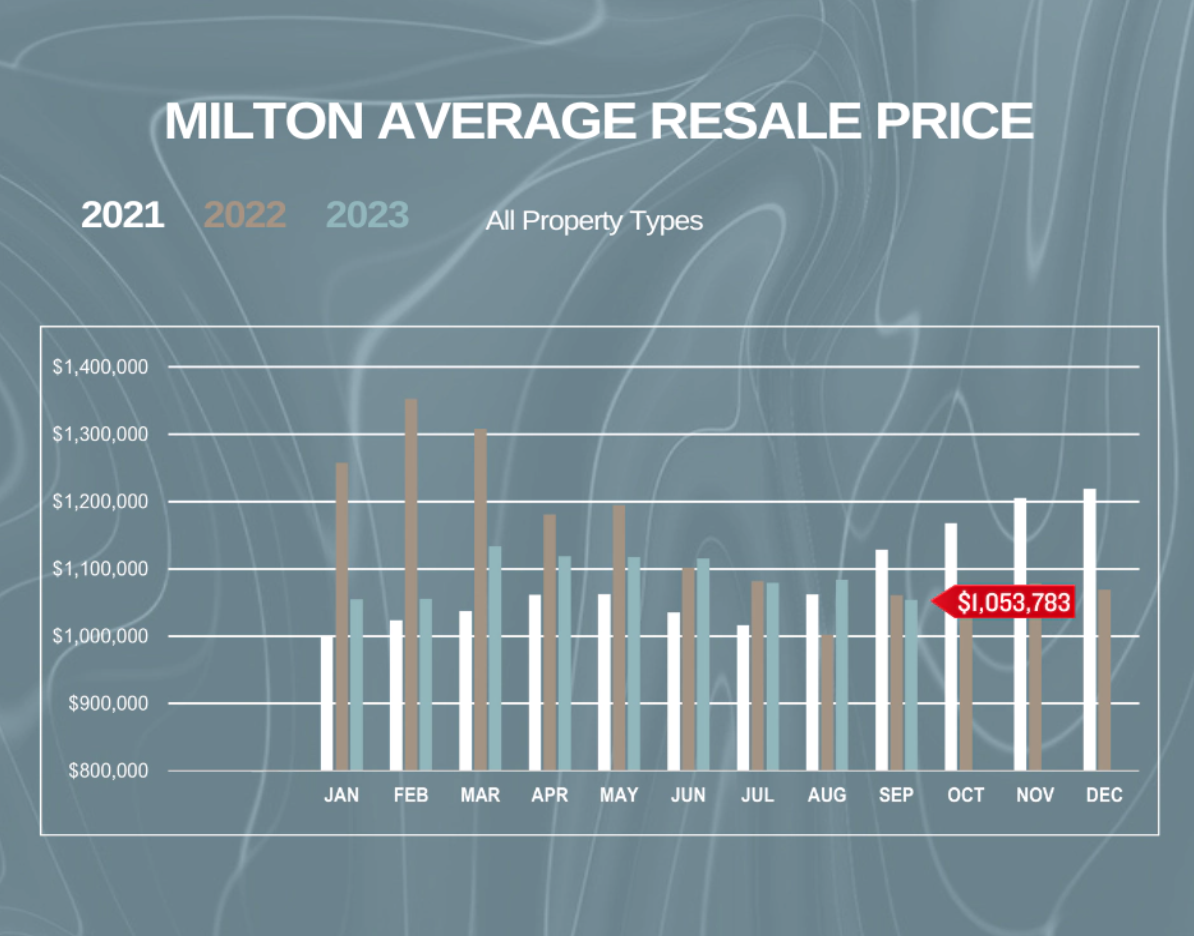

MILTON MARKET INSIGHTS

Market Insights

All property types

SEPTEMBER 2022

FEBRUARY 2024

122

Homes Sold

-18.03%

100

Homes Sold

$1,060,886

Avg. Resale Price

-0.67%

$1,053,783

Avg. Resale Price

SEPTEMBER 2023 STATS

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Apartment

Condo Townhouse

45

14

24

3

14

$1,284,663

$1,053,857

$922,100

$782,100

$595,556

MILTON Average Resale Price

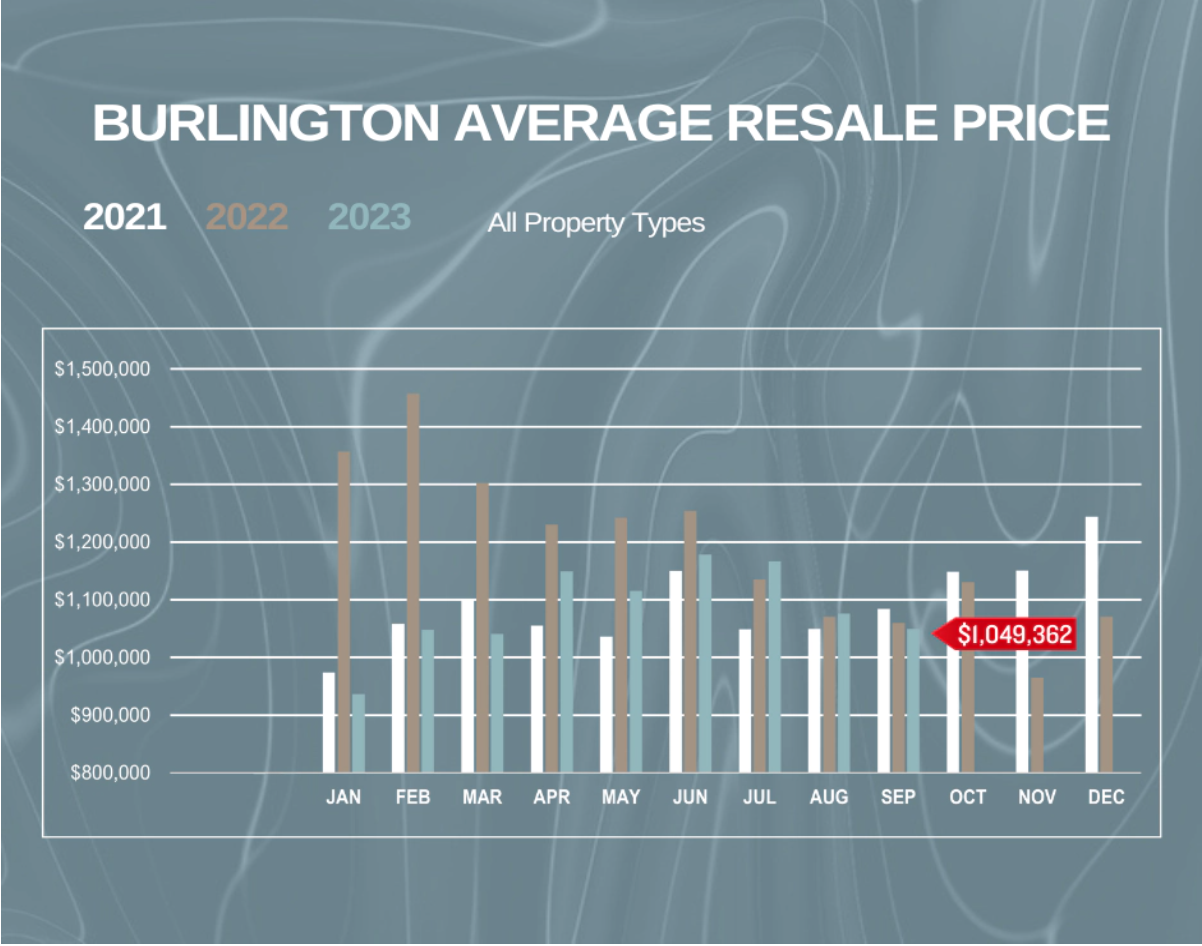

BURLINGTON MARKET INSIGHTS

Market Insights

All property types

SEPTEMBER 2022

SEPTEMBER 2023

182

Homes Sold

-18.68%

148

Homes Sold

$1,059,736

Avg. Resale Price

-0.98%

$1,049,362

Avg. Resale Price

SEPTEMBER 2023 STATS

SALES

AVG PRICE

Detached

Semi-Detached

Townhouse

Condo Townhouse

Condo Apartment

71

8

12

14

40

$1,346,007

$929,863

$958,338

$802,700

$656,808

BURLINGTON Average Resale Price